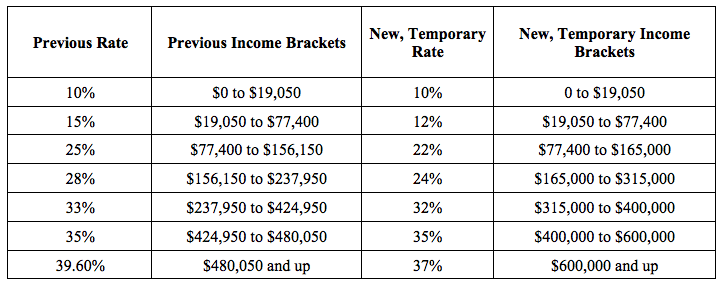

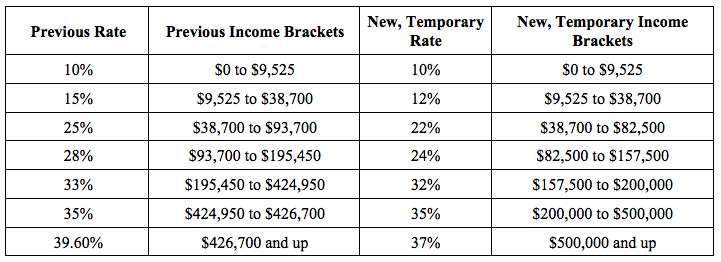

The new tax law shifted the structure of the tax rates and the tax brackets, so the rate that you paid last year may not be the same rate you pay this year. The new plan maintains the seven-bracket structure from the old law but modifies the rates and income thresholds.

The new plan also codifies a permanent and slower measure of inflation, which means that the automatic adjustments that happen every year to ensure that the tax brackets remain relatively constant even as the value of the dollar changes will be smaller than they otherwise would have been. In the long term, that means that people will move into brackets with higher tax rates sooner than they would have under the old law, resulting in a tax increase for those people.

What is my new tax bracket?

Two charts below show the temporary rate and income brackets introduced in the tax plan, and the permanent rate from the old law:

Married Couples Who File Jointly

Single Filers

The temporary rate and brackets expire in 2025 and will revert back to the rates from the old law in 2026. When that happens, people will experience a large tax increase, relative to 2025, and will even be paying more in taxes than they would have under the old law because of the change in inflation measure.